Late in Paying Car Tax? Here’s How to Calculate the Applicable Fines

30 November, 2023

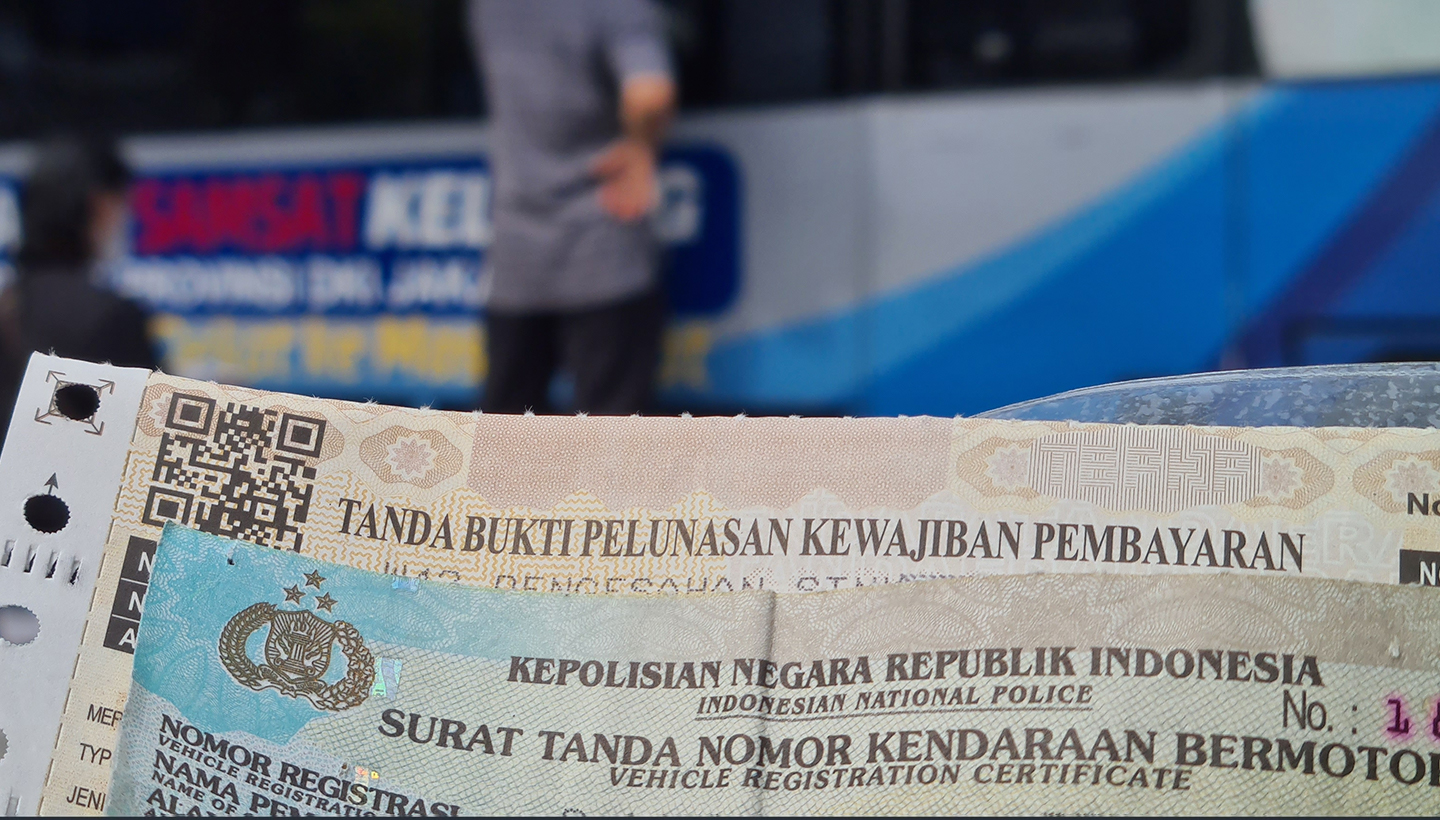

Vehicle tax is an obligation that cannot be ignored by every car owner in Indonesia. Paying car tax late not only has the potential to harm you financially, but can also have an impact on the legality of the vehicle. Therefore, understanding the consequences of late car tax payments is important for every vehicle owner.

If you pay your car tax late, you will be charged a fine. Therefore, it is important to understand how to calculate the fine for late tax payments, because the longer the payment is delayed, the amount of the fine will increase.

So, how do you calculate the applicable car tax fine, starting from 1 day to 1 year, which is currently valid? Read the explanation below.

Fines for Late Payment of Car Tax

Car tax fines are financial sanctions when you miss the tax payment deadline determined by the government. This aims to encourage vehicle owners to be disciplined in fulfilling their tax obligations.

Why are fines applied? Tax fines are not just a sanction but also an instrument to remind every vehicle owner of their responsibility for the country’s development. By paying taxes on time, you contribute to infrastructure development, education, health, and various other social programs.

Car tax fines come into effect after the specified payment deadline has passed. The government usually provides a certain tolerance period, but after exceeding this limit, a fine will be imposed.

Motor vehicle tax fines vary depending on the length of the delay in payment and local government policies. If the delay reaches 24 months or two years, the vehicle owner will be subject to a total fine of 48 percent. Vehicle owners are required to visit the main Samsat office if they are more than one year late in paying taxes.

Calculating Fines for Late Payment of Car Tax

The calculation of the delay period starts from the due date for tax payment. Each day is counted as one day of delay. Therefore, it is important to know exactly the due date for your car tax.

If car tax payments are late by one day in 2023, there will be no additional charges. Vehicle owners only need to pay Motor Vehicle Tax (PKB) as usual, in accordance with Law No. 28 of 2009 concerning Regional Taxes and Regional Levies.

However, if the tax payment is two days late from the specified date, you will be subject to a fine of 25% of the PKB that should have been paid. The following is a list of fines for late payment of PKB according to regulations:

- 1 Day Late: One-Year PKB (Compensation)

- Delay for 2 Days – 1 Month: PKB x 25% x 1/12

- 2 Months Late: PKB x 25% x 2/12 + SWDKLLJ Fine

- 3 Months Late: PKB x 25% x 3/12 + SWDKLLJ Fine

- 6 Months Late: PKB x 25% x 6/12 + SWDKLLJ Fine

- 1 Year Delay: PKB x 25% x 12/12 + SWDKLLJ fine

- 2 Year Delay: 2 x PKB x 25% x 12/12 + SWDKLLJ fine

- 3 Years Late: 3 x PKB x 25% x 12/12 + SWDKLLJ fine.

Example of Calculating Fines for Late Payment of Car Tax

The fine for late-paying car tax is 25 percent of the motor vehicle tax (PKB) for each year. If the late payment is more than one month, the fine can be calculated by simply dividing the amount of the annual fine according to the number of months on a pro-rata basis.

Apart from the PKB fine, there are also other fines that need to be paid, namely the Mandatory Traffic Accident Fund Contribution Fine (SWDKLLJ). The SWDKLLJ fine, according to Minister of Finance Regulation No. 36/PMK.010/2008, is IDR 100,000 for cars.

For example, if the car’s PKB is IDR 4,000,000 and it is 2 months late in paying taxes, the calculation is IDR 4,000,000 x 25 percent x 2/12, resulting in a maximum fine of IDR 166,667. Plus the maximum SWDKLLJ fine of IDR 100,000, the total fine that must be paid is IDR 266,667.

To understand it better, here is the car tax penalty formula and some case studies:

Formula: (PKB x 25 percent x Number of Months Late/12) + SWDKLLJ Fine

1 Month Late Car Tax Fine

- Case Study: Wuling Almaz Car PKB amounting to IDR 4,000,000.

- Calculation: (Rp. 4,000,000 x 0.25 x 1/12) + Rp. 100,000

- Total Fine: Rp. 183,333

2 Months Late Car Tax Fine

- Case Study: Wuling Almaz Car PKB amounting to IDR 4,000,000.

- Calculation: (Rp. 4,000,000 x 0.25 x 2/12) + Rp. 100,000

- Total Fine: IDR 266,667

6 Months Late Car Tax Fine

- Case Study: Wuling Almaz Car PKB is the same as before.

- Calculation: (Rp. 4,000,000 x 0.25 x 6/12) + Rp. 100,000

- Total Fine: IDR 600,000

1 Year Late Car Tax Fine

- Case Study: Almaz Car, PKB

- Calculation: (Rp. 4,000,000 x 0.25 x 12/12) + Rp. 100,000

- Total Fine: IDR 1,100,000

2 Years Late Car Tax Fine

- Case Study: Almaz Car, PKB

- Calculation: (2 x IDR 4,000,000 x 0.25 x 12/12) + IDR 100,000

- Total Fine: IDR 2,100,000.

For late payments of more than 1 day, for example 5 days late, the fine will be calculated in the same way as 1 month late.

How to Check Car Tax Fines

To ensure a more accurate amount of the PKB fine, you can check it online via the official e-Samsat page. Here are the steps you can follow:

- Visit the e-Samsat page using the following link: https://e-samsat.id.

- Fill out the form provided on the page with the requested information, including the plate code, serial number, chassis number, and vehicle province.

- Press the “Check Now” button.

- On this page, you will see information regarding the amount of PKB fees that you have to pay. This information includes PKB POK, PKB DEN, SWDKLLJ POK, SWDKLLJ DEN, PNPB STNK, PNBP TNBK, and tax payment deadlines.

Apart from going through the e-Samsat site, you can also check vehicle tax fines via SMS. Unfortunately, currently, the facility for checking fine status via SMS is only available in several regions of Indonesia. Car users in DKI Jakarta, West Java, and East Java can take advantage of this service. Be sure to check whether this service is available in your area before trying it.

Here are the steps:

- DKI Jakarta: Type “Metro (space) (police number), then send to 1717.

- West Java: Type “West Java Regional Police (space) (police number), then send to 3977.

- East Java: Type “JATIM (space) (police number), then send to 70702.

By checking, you can confirm the amount you have to pay and get the latest information regarding your vehicle tax.

How to Avoid Late Paying Car Tax Fines

To avoid car tax fines, consider the following tips:

- Pay On Time: Avoid fines by paying car tax on schedule. Check the payment schedule at the Samsat office or online application.

- Online Payment: Take advantage of the convenience of paying taxes online via ATM, internet banking, mobile banking, or special applications. This reduces the risk of delays.

- Create Reminders: Prevent forgetfulness by creating reminders using a calendar, alarm, or reminder app to keep track of payment schedules.

- Double Check: Ensure successful car tax payments by double checking after the payment process.

Fines for late payment of car tax are not just a financial burden but also a reflection of non-compliance with the rules and responsibilities as a vehicle owner. By properly understanding how to calculate and the consequences of late tax payments, you can keep your vehicle legal and support the country’s development. Make sure to always comply with vehicle tax regulations and make this obligation a form of your positive contribution as a citizen.